After being evicted earlier in the year, Markeshia was able to find housing for her and her family. Here is her account of what being evicted was like:

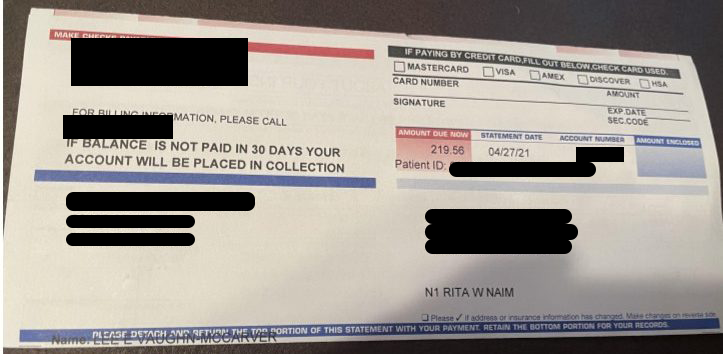

“There was nothing else I could do. At that moment, my back was against the wall. I have my momma and she had COVID in the mix of the [eviction]. We were in one room that was small and she was throwing up, mind you I had recently gotten over it. My kids had [COVID], but it wasn’t too bad. My mother got it the worst. She was throwing up, balled up, and was burning up. She went through the tough symptoms since she was older. I had my mother with COVID, us being put out. She already had COVID when we were [evicted] so was barely moving along trying to keep herself up in the midst of her having pain and stuff like that. And then having her in the room with all the symptoms. It was a lot on my plate.”

Markeshia, hospitality worker, Nevada